The psychology of money explores how emotions, thoughts, and behaviors influence financial decisions. It examines cognitive biases, risk tolerance, and cultural norms shaping wealth-building strategies.

1.1 Understanding the Concept of Money Psychology

Money psychology examines how cognitive biases, emotions, and societal influences shape financial behaviors. It delves into why individuals make irrational decisions, highlighting the emotional and psychological factors that drive spending, saving, and investing patterns, ultimately impacting financial well-being and long-term economic success.

1.2 The Importance of Financial Behavior Analysis

Financial behavior analysis reveals how psychological factors influence monetary decisions, enabling individuals to recognize patterns and avoid costly mistakes. It promotes understanding of motivations behind spending and saving, fostering better financial strategies and improved economic outcomes through self-awareness and informed decision-making.

1.3 Overview of Key Themes in Money Psychology

The psychology of money delves into financial behavior, wealth mindset, and investment strategies. It examines how emotions, cognitive biases, and social influences shape decisions. Key themes include mental accounting, risk tolerance, and the role of cultural norms in shaping financial attitudes and behaviors, offering insights into improving financial well-being.

The Role of Emotions in Financial Decision-Making

Emotions like fear, greed, and anxiety significantly influence financial choices, often leading to impulsive decisions that can affect long-term financial stability and investment outcomes.

2.1 How Fear and Greed Influence Investment Choices

Fear and greed are powerful emotions that drive investment decisions, often leading to irrational behaviors. Fear can cause investors to sell prematurely during market dips, while greed may prompt excessive risk-taking in pursuit of high returns, both undermining long-term financial goals and stability.

2.2 The Impact of Loss Aversion on Financial Decisions

Loss aversion, the tendency to prefer avoiding losses over acquiring gains, profoundly influences financial decisions. Investors often hold losing investments too long and sell winners early, driven by emotional responses to potential losses, which can hinder rational decision-making and long-term financial success.

2.3 Emotional Triggers in Spending and Saving Habits

Emotional triggers significantly influence spending and saving habits. Feelings like stress, excitement, or boredom can lead to impulsive purchases, while fear or contentment may promote saving. Understanding these emotional cues helps individuals develop healthier financial behaviors and achieve better control over their monetary decisions and long-term goals.

Cognitive Biases and Their Financial Implications

Cognitive biases distort financial decision-making, leading to irrational choices. Understanding these biases helps individuals recognize and mitigate their impact, improving overall financial strategies and outcomes effectively.

3.1 Anchoring Bias in Financial Decision-Making

Anchoring bias occurs when individuals rely too heavily on the first piece of information they receive. In finance, this can lead to overpaying for assets or making poor investment choices due to an unrealistic reference point, highlighting the need for awareness to counteract its influence effectively.

3.2 The Endowment Effect and Financial Behavior

The endowment effect refers to the tendency to overvalue possessions simply because they are owned. This bias leads to irrational financial decisions, such as holding onto underperforming investments or overpricing personal assets, hindering objective evaluation and diversification of portfolios.

3.3 Confirmation Bias in Investment Strategies

Confirmation bias leads investors to favor information supporting their existing beliefs, ignoring contradictory data. This selective thinking reinforces risky decisions, such as sticking with losing investments or avoiding diversification, ultimately impacting portfolio performance and financial health negatively.

The Psychology Behind Spending and Saving

Understanding spending and saving habits reveals how mental accounting, impulse buying, and emotional triggers shape financial decisions, often leading to inconsistent saving patterns and impulsive purchases.

4.1 The Role of Mental Accounting in Financial Choices

Mental accounting explains how individuals categorize money into different “accounts” based on its source or intended use, influencing spending and saving decisions. This cognitive framework often leads to irrational financial choices, as people treat money differently depending on its perceived value or origin, impacting overall financial well-being significantly.

4.2 How Impulse Buying Affects Financial Health

Impulse buying often stems from emotional triggers, leading to unplanned purchases that can harm financial stability. It disrupts budgeting, increases debt, and reduces savings, highlighting the need for self-awareness and strategies to curb such behaviors for better financial health and long-term monetary goals.

4.3 The Psychology of Budgeting and Saving

Budgeting and saving are deeply influenced by psychological factors like self-control, motivation, and mental accounting. Effective strategies often involve setting clear goals, automating savings, and using visual reminders to maintain discipline, fostering a disciplined approach to managing finances and achieving long-term economic stability.

Social Influence on Financial Behavior

Social environments significantly shape financial decisions, with peer pressure, social status, and cultural norms influencing spending and saving habits, often leading to irrational choices.

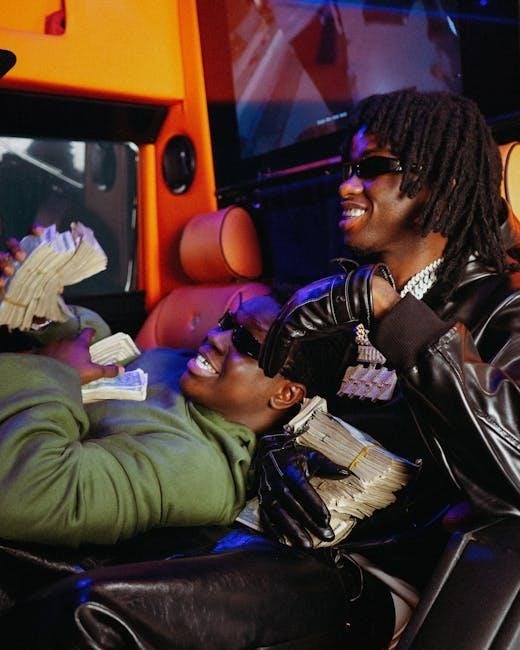

5.1 The Impact of Peer Pressure on Spending Habits

Peer pressure significantly influences spending habits, often leading individuals to make purchases they might not afford to maintain social status or fit in with their social circle.

5.2 Social Status and Consumer Behavior

Social status often drives consumer behavior, as individuals purchase luxury goods or high-end services to signal wealth and prestige. This desire for status can lead to overspending, prioritizing visible consumption over long-term financial stability.

5.3 The Role of Cultural Norms in Financial Decisions

Cultural norms significantly influence financial decisions, shaping attitudes toward saving, spending, and investing. For instance, some cultures emphasize collective financial responsibility, while others prioritize individual wealth accumulation, impacting overall financial behavior and goals.

Behavioral Economics and Financial Decisions

Behavioral economics combines psychology and finance to explain irrational financial behaviors, revealing how cognitive biases and heuristics shape decisions, often diverging from traditional economic theories of rational choice.

6.1 Understanding Behavioral Economics Basics

Behavioral economics studies how psychological, social, and emotional factors influence economic decisions. It challenges traditional theories by incorporating real-world human behavior, revealing systematic cognitive biases and heuristics that often lead to irrational financial choices and suboptimal outcomes. This field bridges the gap between economics and psychology to better understand decision-making processes.

6.2 The Role of Nudges in Financial Behavior

Nudges are subtle interventions that influence financial decisions without restricting freedom. They leverage psychological biases to encourage positive behaviors, such as saving or investing. By framing choices effectively, nudges can improve financial outcomes, helping individuals make better decisions effortlessly, thus enhancing overall financial well-being and long-term economic stability.

6.3 How Behavioral Economics Shapes Investment Strategies

Behavioral economics examines how psychological factors influence investment decisions, revealing biases like loss aversion and overconfidence. These insights help investors recognize emotional pitfalls, enabling better risk assessments and diversification. By understanding cognitive distortions, investors can adopt strategies that mitigate irrational behaviors, leading to more informed, balanced, and effective investment choices over time.

The Psychology of Wealth and Prosperity

The psychology of wealth explores the mindset and behaviors of prosperous individuals, highlighting traits like gratitude, resilience, and long-term thinking that foster financial success and stability.

7.1 The Mindset of Wealthy Individuals

Wealthy individuals often exhibit a growth mindset, prioritizing long-term goals over short-term gains. They embrace financial literacy, resilience, and strategic risk-taking, fostering a culture of continuous learning and disciplined investment strategies to sustain prosperity and achieve lasting financial success.

7.2 The Role of Gratitude in Financial Success

Gratitude fosters a positive mindset, enhancing financial well-being by encouraging contentment and wise spending. It reduces impulse purchases, promotes saving, and strengthens relationships, creating a foundation for sustainable financial success and overall life satisfaction.

7.3 The Psychology of Long-Term Wealth Building

Long-term wealth building requires discipline, patience, and a mindset focused on sustainability. It involves avoiding get-rich-quick schemes, embracing compounding, and living below one’s means. Consistent investing, coupled with resilience during market fluctuations, fosters financial stability and growth over time, creating a lasting legacy of prosperity and security.

Financial Psychology and Investment Strategies

Financial psychology examines how psychological factors influence investment decisions, helping investors recognize their motivations and biases. Understanding these elements allows for more informed, strategic financial planning.

8.1 The Role of Risk Tolerance in Investment Decisions

Risk tolerance plays a crucial role in shaping investment decisions, as it reflects an individual’s comfort with market volatility and potential losses. Understanding personal risk tolerance helps align investment strategies with financial goals and emotional resilience. Proper assessment ensures balanced portfolios and informed decision-making.

8.2 The Impact of Overconfidence on Financial Outcomes

Overconfidence often leads investors to overestimate their ability to predict market trends, resulting in risky decisions and poor financial outcomes. This bias stems from emotional and cognitive factors, causing individuals to ignore data and diversification, ultimately undermining their investment strategies and long-term financial goals.

8.3 The Psychology of Diversification and Portfolio Management

Diversification is driven by the psychology of risk aversion, as spreading investments reduces exposure to single-asset volatility. Behavioral factors like fear of loss and desire for stability influence portfolio choices, often leading to more balanced and resilient financial strategies that align with long-term goals and emotional comfort.

Practical Strategies for Improving Financial Well-Being

Developing financial literacy, setting clear goals, and automating savings are key strategies. Avoid lifestyle inflation and practice mindful spending to build lasting financial stability and peace of mind.

9.1 Developing a Healthy Relationship with Money

Recognizing money as a tool, not a goal, is crucial. Setting boundaries, avoiding impulse buys, and embracing gratitude fosters mindfulness. This mindset helps prioritize needs over wants, promoting financial well-being and long-term stability.

9.2 The Importance of Financial Literacy

Financial literacy empowers individuals to make informed decisions, reducing reliance on assumptions. It enhances understanding of saving, investing, and debt management, fostering better money habits and reducing cognitive biases that hinder wealth-building strategies.

9.3 Applying Psychological Insights to Achieve Financial Goals

Applying psychological insights involves understanding behavioral economics and recognizing cognitive biases. Setting clear financial goals aligned with personal values enhances motivation. Techniques like mental accounting and self-awareness help manage spending and saving, fostering disciplined financial decisions and long-term wealth-building strategies.

Leave a Reply

You must be logged in to post a comment.